How Institutional Investors Are Shaping Crypto in 2025

“Crypto is no longer just a game for retail investors.”

In 2025, as you know how major financial institutions- such as BlackRock, Fidelity, and Goldman Sachs have carved out their space in the crypto market. Crypto is no longer a speculative asset, but rather becoming a mainstream investment vehicle. Institutional investors have the biggest role behind this transformation.

So let’s understand how these big players are shaping the crypto market.

What Are Institutional Investors?

You should know who the Institutional investors are: Who make large-scale investments. Such as – Pension Funds, Mutual Funds, Insurance Companies, Hedge Funds, Banks (like – JP Morgan, Morgan Stanley). Their goal is to generate long-term stable returns and make the market operate efficiently.

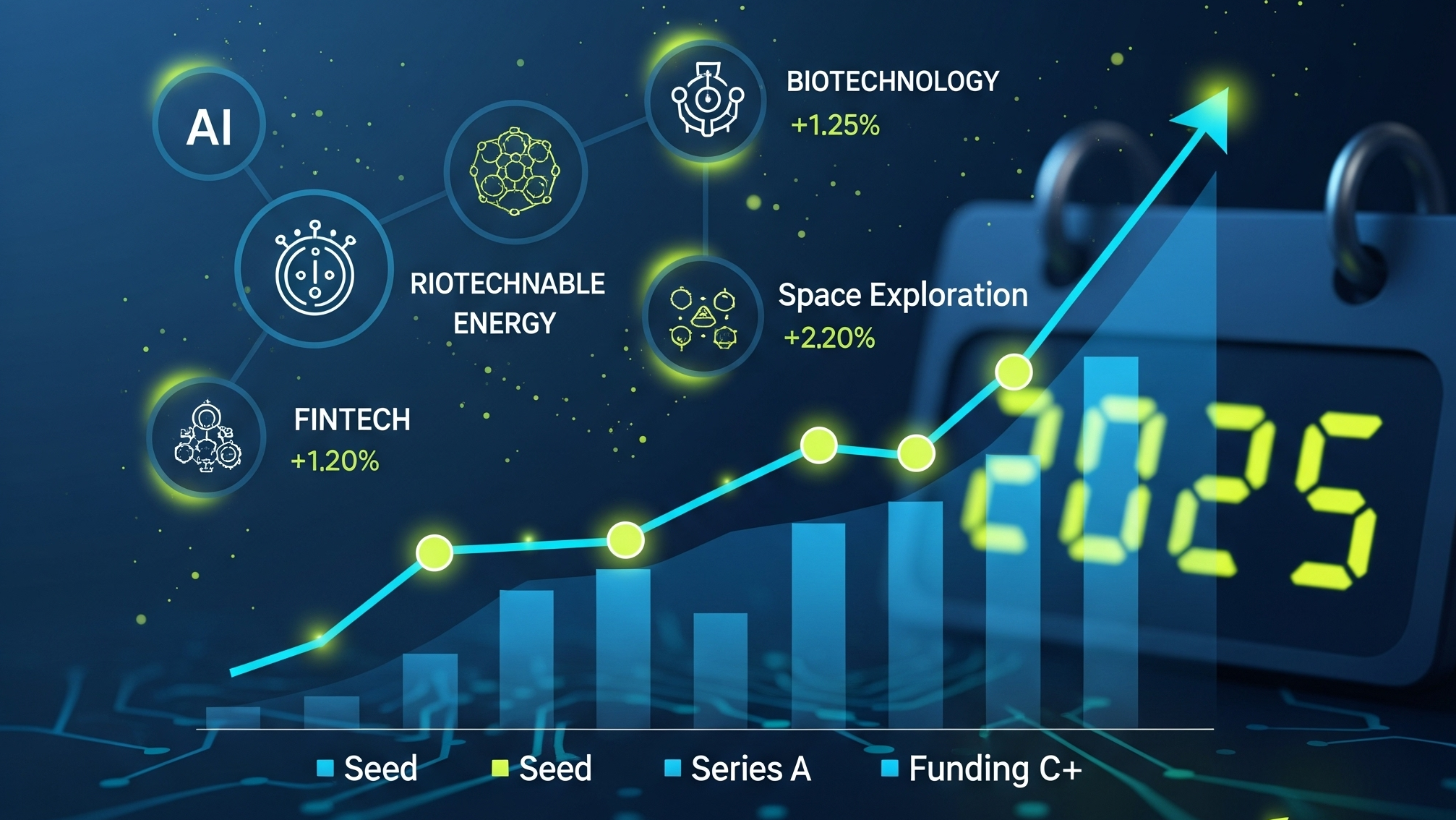

Why Are Institutions Entering Crypto in 2025?

Bitcoin is being considered digital gold, especially in times of high inflation.

Crypto regulations in the USA, UK, and Europe have now become more transparent.

Crypto has become a new asset class with an attractive risk-reward profile.

Spot Bitcoin ETFs have made investing simplified and compliant.

Impact on Crypto Markets

Large capital inflows have improved market liquidity, which means tighter spreads and better price discovery.

Institutions are long-term holders — their entry and HODL behavior reduces market volatility.

Focus on Quality Projects:

Compliance and Risk Management:

Challenges and Concerns

Some Real-Life Examples :

Also Read:

Bitcoin Price Prediction

Is Bitcoin still a safe haven asset

The Road Ahead: What to Expect in H2 2025 and Beyond

Conclusion: A Turning Point for Crypto

In 2025, the crypto market will enter the institutional phase. For retail investors, this is the time for strategic investing — not behind the hype, but with data.

“The future of crypto is no longer just decentralization, but also mainstream adoption.”